Analysis of Trades and Trading Tips for the British Pound

The test of the 1.2519 price level coincided with the MACD indicator just beginning to move upward from the zero mark, confirming the validity of entering a buy position for the pound, which resulted in a 30-pip increase in the pair.

Traders reacted to news of declining retail sales volumes, which fell short of analysts' expectations. Despite this negative signal, the British pound demonstrated resilience due to expectations that the UK's monetary policy would remain unchanged. Investors continue to monitor the actions of the Bank of England, which may consider raising interest rates in the future despite current economic challenges. However, by the afternoon, the release of weak economic data from the US shifted the situation. Data on employment and consumer spending came in worse than expected, raising doubts about the sustainability of the Federal Reserve's tight monetary policy.

Today, some significant data releases are expected. Changes in the gross domestic product (GDP) volume are anticipated to indicate the country's overall economic health. If the figures show growth, it could signal recovery from economic shocks. Conversely, a GDP contraction may point to ongoing economic challenges. Additionally, the current account balance is of critical importance. This measure reflects the difference between exporting and importing goods and services. An improvement in the figure may indicate competitiveness in the UK economy on global markets, while a deterioration could raise concerns about current trade trends. Finally, the comprehensive change in investment volumes will also be a defining factor. Prioritizing investments in innovation and infrastructure is a key driver for long-term economic growth and stability.

If the data is weak, the pound will have little to no chance of rising today. Regarding intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

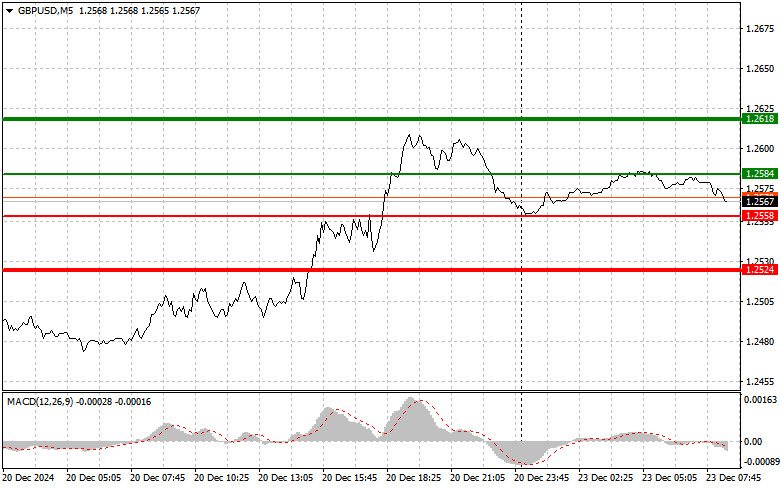

Scenario #1: Today, I plan to buy the pound if the entry point around 1.2584 (green line on the chart) is reached, targeting a rise to 1.2618 (thicker green line on the chart). Around 1.2618, I plan to exit purchases and open sales in the opposite direction (expecting a movement of 30-35 pips in the opposite direction from the level). A rise in the pound can only be expected after favorable data. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the pound today if the price tests 1.2558 twice consecutively while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. Growth to the opposite levels of 1.2584 and 1.2618 can be expected.

Sell Signal

Scenario #1: Today, I plan to sell the pound after the level of 1.2558 (red line on the chart) is breached, which will lead to a quick decline in the pair. The key target for sellers will be 1.2524, where I plan to exit sales and immediately open purchases in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). Selling the pound is viable in the case of weak GDP data. Important! Before selling, make sure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the pound today if the price at 1.2584 is tested twice consecutively while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.2558 and 1.2524 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.