Trade Review and Tips for Trading the Euro

The test of the 1.1361 level occurred at a time when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I didn't buy euros and missed the entire upward move.

The German economy is showing signs of stable development, which has had a positive impact on the euro. Surprisingly, the data exceeded economists' forecasts. The latest figures from the IFO Institute regarding business climate and economic outlook in Germany came in above expectations, indicating ongoing optimism and confidence among German businesses despite global economic uncertainty and geopolitical tensions. Positive developments in Germany's economic climate could significantly affect the entire eurozone by encouraging investment inflows, job creation, and increased consumer spending. Moreover, solid economic data from Germany may prompt the European Central Bank to reconsider its current monetary policy in favor of further easing.

In the second half of the day, we await figures on initial jobless claims and durable goods orders in the U.S. It is worth noting that markets are currently highly sensitive to any macroeconomic signals, and even minor deviations from expectations could trigger sharp moves. Special attention will also be paid to the core durable goods orders (excluding transportation), which is seen as a more accurate indicator of manufacturing activity. Additionally, traders are closely monitoring mortgage rate dynamics and their impact on existing home sales. The absence of a clear trend toward lower interest rates in the U.S. could restrain the housing market, which in turn may negatively affect investor sentiment.

As for the intraday strategy, I will continue to focus on the implementation of scenarios #1 and #2.

Buy Signal

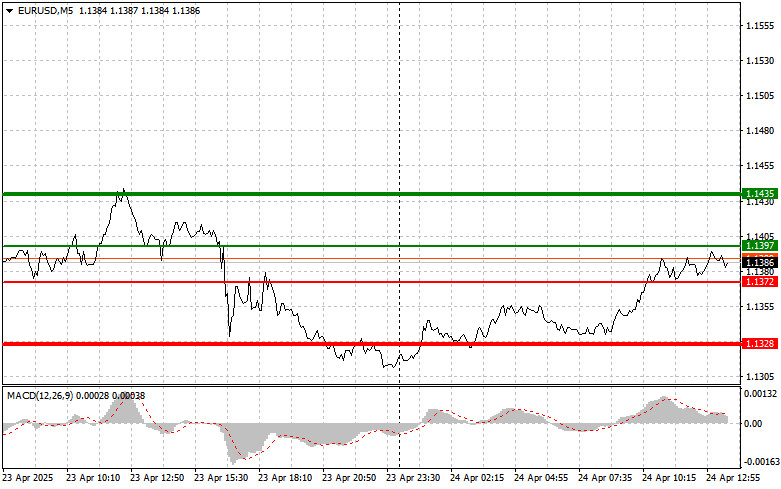

Scenario #1: I plan to buy the euro today upon reaching the 1.1397 entry level (green line on the chart) with a target of rising toward 1.1435. At 1.1435, I plan to exit long positions and open short positions in the opposite direction, aiming for a 30–35 point pullback from the entry point. Buying the euro is advisable only after weak U.S. data. Important! Before entering a long position, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy euros today in case of two consecutive tests of the 1.1372 level, at a time when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal to the upside. Growth toward 1.1397 and 1.1435 can be expected.

Sell Signal

Scenario #1: I plan to sell euros after the pair reaches the 1.1372 level (red line on the chart). The target will be the 1.1328 level, where I plan to exit short positions and buy immediately in the opposite direction (looking for a 20–25 point rebound from the level). Downward pressure on the pair will return today only in the case of strong U.S. data. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell euros today in case of two consecutive tests of the 1.1397 level, at a time when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal to the downside. A decline toward 1.1372 and 1.1328 can be expected.

What's on the Chart:

- Thin green line – entry price for buying the trading instrument

- Thick green line – target price for Take Profit or manual profit-taking; above this level further growth is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – target price for Take Profit or manual profit-taking; below this level further decline is unlikely

- MACD Indicator – when entering the market, use overbought and oversold zones as confirmation signals

Important Note: Beginner traders in the Forex market must exercise extreme caution when entering the market. It is best to stay out before major fundamental reports are released to avoid sudden price swings. If you decide to trade during news events, always place stop-loss orders to minimize potential losses. Without them, you could quickly lose your entire deposit, especially if you don't use proper money management or trade with large volumes.

And remember: for successful trading, it is essential to have a clear trading plan—such as the one outlined above. Making spontaneous decisions based on current market conditions is a losing strategy for intraday traders.