Analysis of Trades and Trading Tips for the Japanese Yen

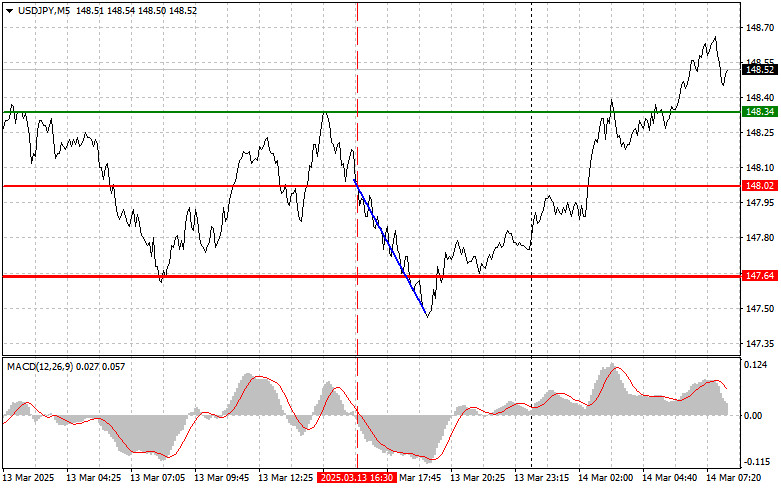

The test of the price level at 148.02 occurred when the MACD indicator had just started to move downward from the zero mark, confirming a valid entry point for selling the dollar. As a result, the pair dropped to the target level of 147.64. Buying at that level on a rebound allowed for an additional profit of 40 pips.

Expectations of further interest rate hikes by the Bank of Japan continue to drive purchases of the yen. Investors looking to capitalize on potential increases in returns from Japanese assets are actively converting foreign currencies into yen. This process supports the national currency, making it more attractive in the international market. Economists believe that the Bank of Japan will likely continue tightening its monetary policy due to ongoing inflationary pressures. Further rate hikes could increase capital inflows into Japan, thereby strengthening the yen's upward trend.

At the same time, the likelihood of a more dovish stance from the U.S. Federal Reserve has increased, as recent inflation data has come in significantly below economists' forecasts. This has fueled investor optimism, interpreting the slowing inflation as a potential signal for rate cuts. Market participants are adjusting their expectations for future Fed policy, which is reflected in the movements of the dollar.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

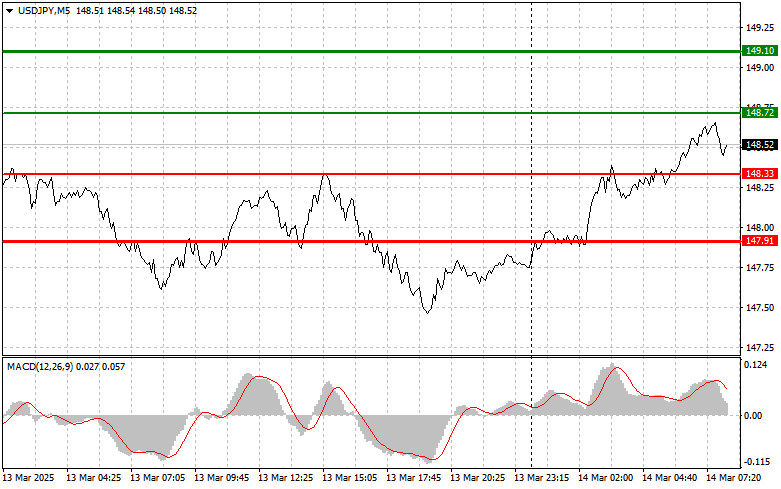

Scenario #1: I plan to buy USD/JPY today if the entry point reaches 148.72 (green line on the chart), targeting a rise to 149.10 (thicker green line on the chart). Around 149.10, I will exit my buy trades and open sell trades in the opposite direction, expecting a 30-35 pips downward movement. It's best to return to buying the pair during corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy USD/JPY if the price tests 148.33 twice in a row while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger a market reversal to the upside. Growth toward the 148.72 and 149.10 levels can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY only after breaking below 148.33 (red line on the chart), which could trigger a rapid decline. The key target for sellers will be 147.91, where I intend to exit my sell trades and immediately open buy trades in the opposite direction, expecting a movement of 20-25 pips upward. Selling pressure on the pair could return at any moment. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell USD/JPY if the price tests 148.72 twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the 148.33 and 147.91 levels can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.