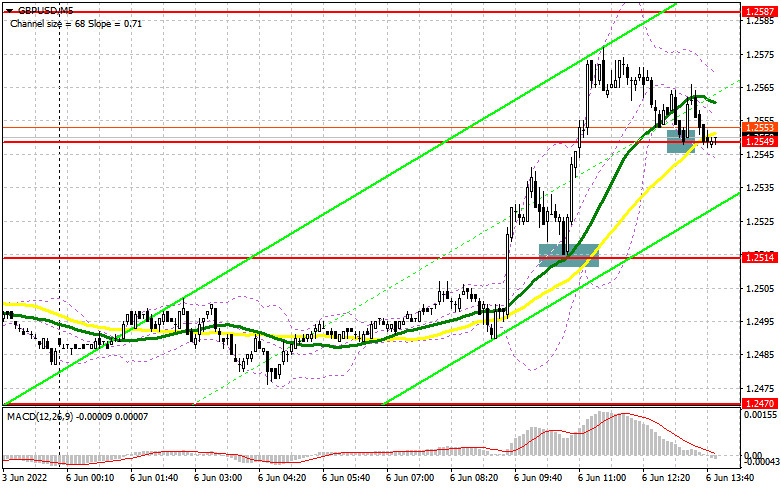

In my morning forecast, I paid attention to the level of 1.2514 and 1.2549. Let's look at the 5-minute chart and figure out what happened. The lack of statistics and the breakthrough of 1.2514 allowed us to count on the formation of a buy signal for the pound, which did not have to wait very long. The reverse top-down test of 1.2514 gave an excellent signal to open long positions, which led to an increase in the pair by more than 60 points. A similar consolidation and a top-down test of 1.2549 is also a buy signal. However, I did not wait for large growth. At the time of writing, the price has returned to 1.2549, which knocked the deal to zero. The technical picture changed for the afternoon. And what were the entry points for the euro this morning?

To open long positions on GBP/USD, you need:

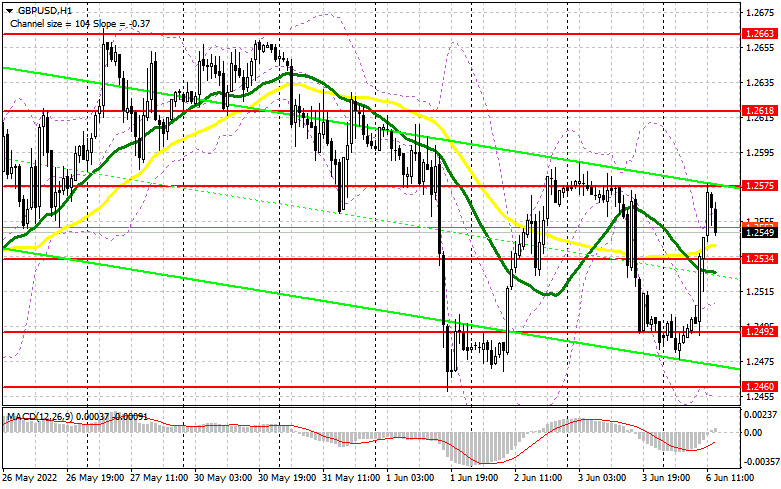

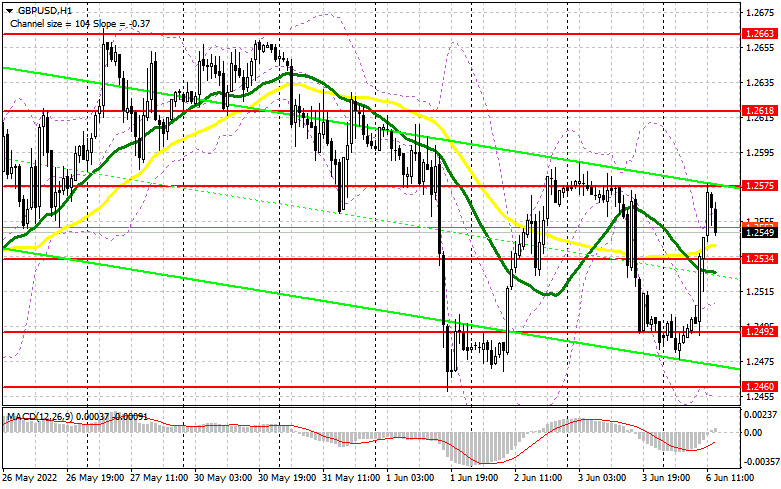

Given that there is no data on the US in the afternoon, I advise you to bet on another attempt by the bulls to get above 1.2575 - a new resistance level formed following the results of the European session. In the case of a decline in the pound, only the formation of a false breakdown at 1.2534 - the level was also formed in the first half of the day and there are moving averages playing on the buyers' side - will allow us to count on the continuation of the bullish trend. But for the complete removal of sellers, an important task of the bulls will be to consolidate above 1.2575. A reverse test from the top-down of this range forms a buy signal, which will open the way to a maximum of 1.2618. A breakdown of this range will also return GBP/USD to the resistance area: 1.2663 and 1.2709, where I recommend fixing the profits. If the pound declines in the afternoon and there are no buyers at 1.2534, the pressure on the pair will increase again. This will allow you to return to 1.2492, where I advise you to open long positions only after a false breakdown. You can buy GBP/USD immediately for a rebound from 1.2460, or even lower - around 1.2411 with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

Bears still have a chance to get the market back under their control. To do this, it is necessary to protect the resistance of 1.2575, the test of which can take place in the near future, since bulls will not simply leave the market - especially in the absence of important statistics on the United States. Only the formation of a false breakdown there will give a signal to open short positions to correct the pair to the area of 1.2534, where the moving averages are. An equally important task for sellers will be to consolidate below this range. A breakout and a reverse test from the bottom up of 1.2534 will form an additional sell signal, allowing GBP/USD to return to the area of 1.2492, from which the most active growth of the pair was observed in the morning. A breakout of this range will also open a direct road to a minimum of 1.2460, where I recommend fixing profits. The longer-term target will be a minimum of 1.2411, which will completely cancel out the bull market. With the option of GBP/USD growth and lack of activity at 1.2575 in the afternoon, an upward jerk may occur against the background of the demolition of sellers' stop orders. In this case, I advise you to postpone short positions to a maximum of 1.2618. I advise you to sell the pound there only if there is a false breakdown. Short positions can be made immediately for a rebound from 1.2663, or even higher - from 1.2709, counting on the pair's rebound down by 30-35 points inside the day.

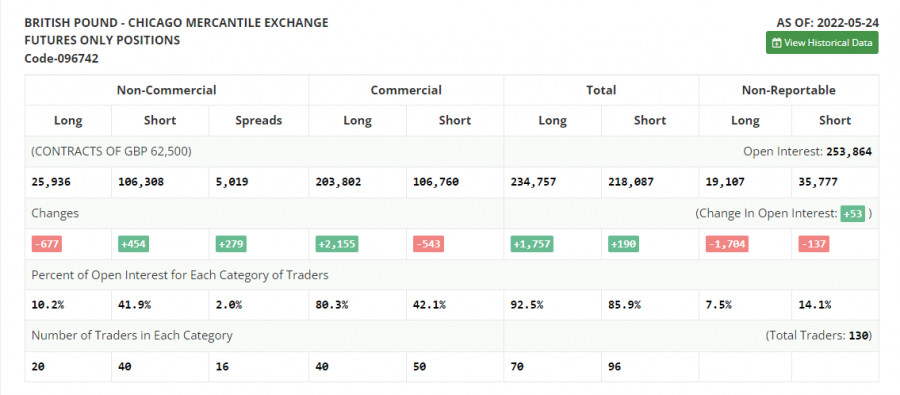

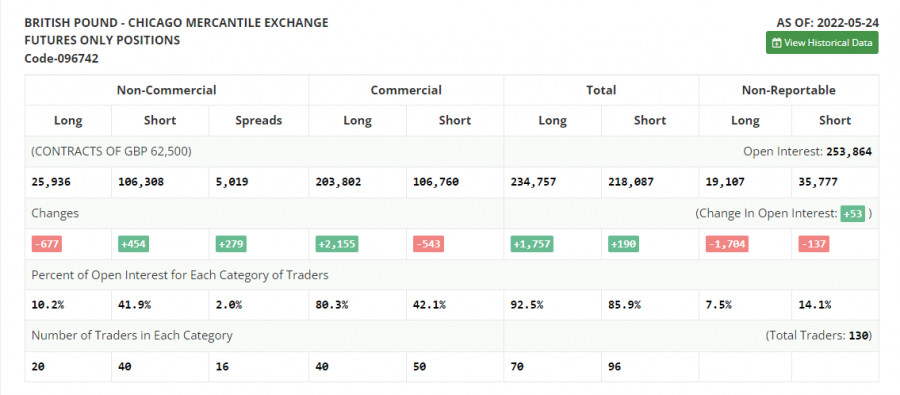

The COT report (Commitment of Traders) for May 24 recorded a reduction in long positions and an increase in short ones. However, this did not significantly affect the balance of power. Despite the growth of the pound since the middle of this month, the market remains completely under the control of sellers. Only the lack of fundamental statistics, to which the pair have been reacting quite negatively lately, and small profit-taking from annual lows allowed GBP/USD to recover a little. There are no other objective reasons for growth. The economy continues to slide into recession, inflation is breaking new records, and the cost of living in the UK is steadily rising. The Bank of England continues to rush between two fires, but even despite all this, the governor of the Bank of England, Andrew Bailey, continues to say that the regulator is not going to give up on raising interest rates yet. Rumors spread that the US central bank plans to "pause" the cycle of interest rate hikes in September this year continue to gain momentum, which puts little pressure on the US dollar and leads to a strengthening of the pound. The COT report for May 24 indicated that long non-commercial positions decreased by -667 to the level of 25,936, while short non-commercial positions increased by 454 to the level of 106,308. This led to an increase in the negative value of the non-commercial net position from the level of -79,241 to the level of -80,372. The weekly closing price rose from 1.2481 to 1.2511.

Signals of indicators:Moving averagesTrading is conducted slightly above 30 and 50 daily moving averages, which indicates an attempt by buyers to return to the market.Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.Bollinger BandsIn the case of growth, the upper limit of the indicator around 1.2570 will act as resistance. In case of a decline, the lower limit of the indicator around 1.2460 will provide support.Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.