GBP/USD

Brief Analysis:

Since late August, the British pound has been forming a bearish wave against the US dollar, weakening its position. This segment is part of a larger corrective wave. Over the past three weeks, quotes have been retracing upward from the lower boundary of a strong potential reversal zone. However, this segment lacks reversal potential.

Weekly Forecast:

In the first half of the upcoming week, a continuation of the sideways movement is expected for the pound. A decline may occur, but not beyond the lower boundary of the calculated support zone. Increased activity, a reversal, and a return to an upward trend are most likely towards the end of the week.

Potential Reversal Zones:

- Resistance: 1.2780–1.2830

- Support: 1.2490–1.2440

Recommendations:

- Sell: Limited potential. Safer to reduce trading volume sizes.

- Buy: Consider trades after confirmed reversal signals near the support zone.

AUD/USD

Brief Analysis:

The latest segment of the dominant bearish trend for the Australian dollar began on September 30. Quotes have reached the upper boundary of a strong potential reversal zone. While the wave structure does not appear incomplete, there are no signs of an imminent trend reversal.

Weekly Forecast:

At the start of the week, price fluctuations are expected to remain flat. Pressure on the support zone may occur, followed by a reversal and a resumption of price increases towards the calculated resistance level.

Potential Reversal Zones:

- Resistance: 0.6430–0.6480

- Support: 0.6330–0.6280

Recommendations:

- Sell: No favorable conditions for such trades in the coming days.

- Buy: Trades may become relevant after confirmed reversal signals near the support zone.

USD/CHF

Brief Analysis:

The upward wave for the Swiss franc pair that began in early August has entered its final phase. A month ago, the price broke into a wide potential reversal zone and is now nearing its upper boundary. No signs of an imminent reversal are visible.

Weekly Forecast:

The early part of the week will likely see the completion of the upward movement, with prices reaching the resistance zone. In the second half, a sideways movement is expected, followed by a reversal and the resumption of downward movement. The lower boundary of the weekly range is defined by the support zone.

Potential Reversal Zones:

- Resistance: 0.8980–0.9030

- Support: 0.8750–0.8700

Recommendations:

- Sell: Premature until the current rise is complete.

- Buy: Possible with reduced volume sizes in individual sessions, with potential limited by the resistance zone.

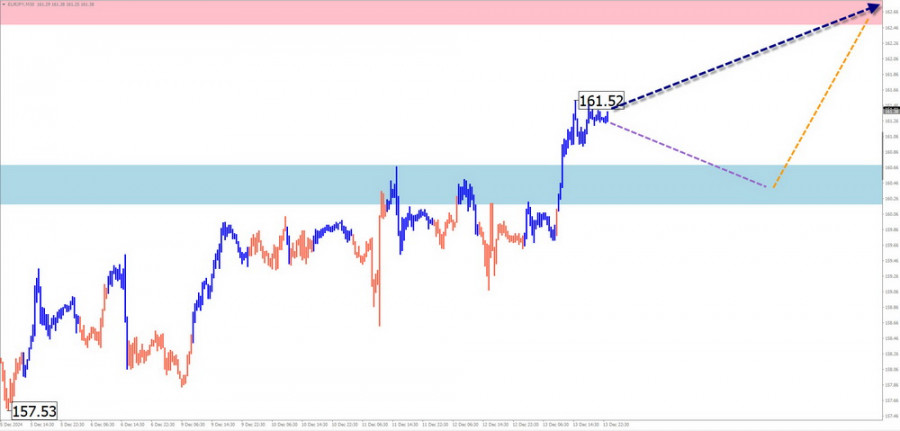

EUR/JPY

Brief Analysis:

The short-term price direction for the EUR/JPY pair is currently set by an upward wave beginning August 5. The final segment (C) of this wave is forming. Since early December, the pair has been moving bullishly from the support zone, displaying reversal potential, which will likely continue after confirmation via a correction.

Weekly Forecast:

A continued price rise is expected this week. The pair is likely to reach the calculated resistance zone. In the early days, a sideways movement or a dip to the support zone is possible. Increased activity is likely towards the weekend.

Potential Reversal Zones:

- Resistance: 162.50–163.00

- Support: 160.70–160.20

Recommendations:

- Sell: Limited potential and could result in losses.

- Buy: Possible with fractional volume sizes after confirmed reversal signals near the support zone.

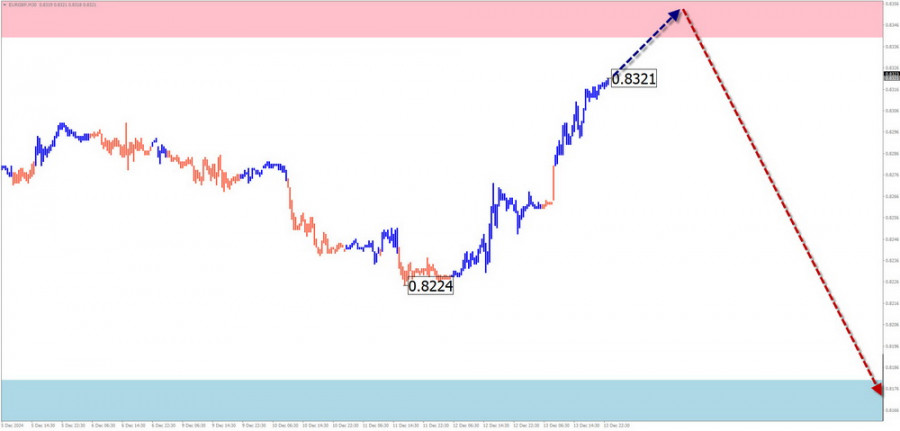

EUR/GBP

Brief Analysis:

The EUR/GBP pair is currently trending downward, guided by a bearish wave from February 3. An incomplete segment has been forming since early August. Over the past weeks, quotes have shown an intermediate retracement within this segment, nearing the lower boundary of the calculated resistance zone.

Weekly Forecast:

The upward price movement is likely to conclude early in the week. A reversal near the resistance zone is expected, followed by a resumption of downward movement. Increased activity is anticipated toward the end of the week.

Potential Reversal Zones:

- Resistance: 0.8340–0.8390

- Support: 0.8180–0.8130

Recommendations:

- Buy: Possible with fractional volume sizes for intraday trades.

- Sell: Consider trades after reversal signals near the resistance zone.

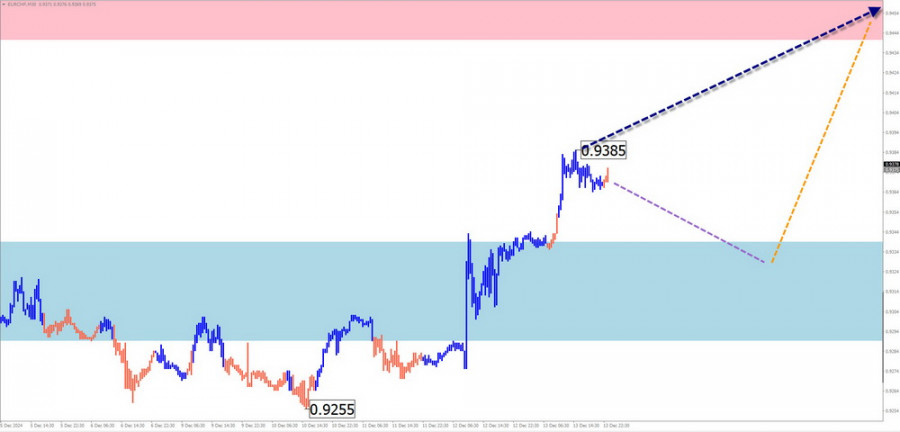

EUR/CHF

Brief Analysis:

The EUR/CHF pair has been trending upward since early August. The latest incomplete segment began on November 22. The wave structure remains unfinished at the time of analysis.

Weekly Forecast:

Sideways movement is expected in the early part of the week, with potential dips to the support zone. In the second half, a reversal and a resumption of upward movement are likely, with the calculated resistance serving as the preliminary target zone.

Potential Reversal Zones:

- Resistance: 0.9440–0.9490

- Support: 0.9340–0.9290

Recommendations:

- Sell: Possible with reduced volume sizes for intraday trades.

- Buy: Relevant after confirmed reversal signals near the support zone.

Explanatory Notes

- In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). The analysis focuses on the last incomplete wave in each timeframe.

- Dashed lines represent anticipated movements.

- Important: The wave algorithm does not account for the duration of price movements over time!