Dear colleagues,

The world hid in anticipation of a Federal Reserve rate hike. Even people who are far from the financial markets know that on Wednesday evening, September 21, an event is about to occur that can plunge the global economy into shock. However, is this really so - let's figure it out in this article.

To be clear, I'm not going to belittle the significance of the event that will take place, but we should understand that the Fed has mastered the art of communication well enough to prepare the markets for the decision of the Open Market Committee. Therefore, the main attention of investors will be given to the so-called "economic forecasts", during which it will become clear what is planned to be done in the near future in monetary policy and what will be the pace of the rate hike.

In turn, traders will be interested to understand what should be expected from the US dollar in the foreseeable future and what will happen in the stock market in the coming months. To understand this, we need to understand the relationship between stocks, the US dollar, rate hikes, and bond yields.

By itself, the rate hike does not pose any significant problems for the markets. Stocks can do just fine in the face of tight monetary policy, although of course for some heavily indebted and so-called growth companies this can really be a problem.

Conventional wisdom suggests that the cheap liquidity that fueled the stock markets could dry up, causing problems for investors forced to repay their loans, and the rising cost of borrowed funds, in turn, will lead to an outflow of capital from financial markets. Indeed, a year ago the market looked overheated. Indeed, with the increase in the cost of mortgage lending, borrowers began to have problems. All this is true, but it is clearly not enough for the markets to start a steep fall, similar to what we saw on Tuesday and Wednesday in the Russian market.

I will remind readers that three very significant reasons were required to start the sell-off, which led to a drop in quotes by a third of their value. First, the government imposed an additional tax on leading corporations, which effectively deprived investors of dividends for the next two years. Secondly, the announcement of referendums on joining Russia in a number of regions of Ukraine. Thirdly, the expectation of an extraordinary appeal by President Putin and Defense Minister Shoigu.

In this regard, it is extremely unlikely that US stocks will start to fall sharply due to the increase that everyone already knows about. A one-time decline in quotes by a few percent is, of course, possible, but in order to convert this movement into a trend, it will take more time and several negative events. Therefore, I do not bet now on the collapse of the US stock market. If it happens, then most likely not now and not tomorrow. October or November? Yes, it's possible, but not necessary.

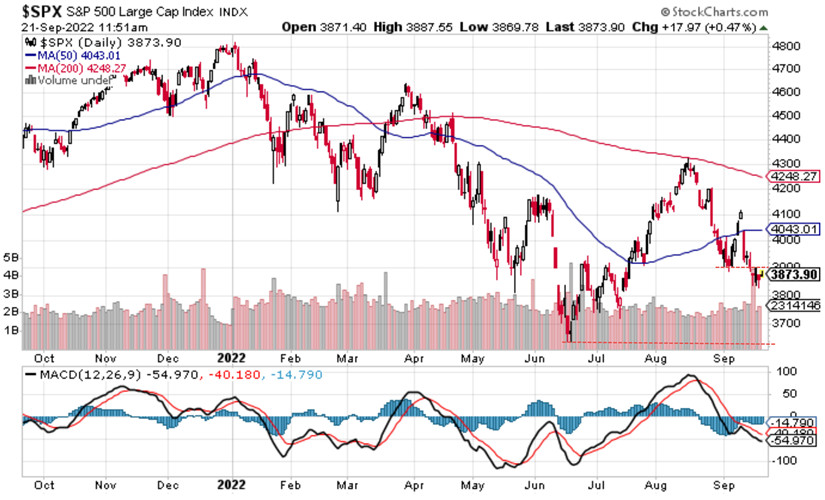

fig.1: Stock market, S&P 500 index

From a technical point of view, the index is in a downward trend, below the support level of 3900, which suggests a further decline in quotes to the level of 3600, but so far no more. In other words, the index may already be at this level this week, but in order to overcome this level, it will need a serious driver, such as the collapse of the Lehman brothers bank, which can cause a global margin call.

However, raising the rate is fraught with much more danger for the American economy than just a decline in stock markets. A rather serious problem for the US budget is the increase in long-term rates on government treasury bonds.

This week, the yield on US 10-year bonds has exceeded 3.5%, and this is already quite a lot, given that the Treasury has to borrow about 6.5 trillion dollars annually: - 4.5 trillion to roll over the debt, and another 2 trillion to pay off the state budget deficit. We borrowed money at a low rate of return, and now we have to renew the loan at high rates. An increase in the rate on long-term bonds by only 1% causes an increase in debt servicing by 60-70 billion dollars a year.

Someone can say that the amount of 60 billion is only 1% of the US budget, and they will be right. So after all, bond yields continue to rise, and when it exceeds the 4% level and remains above it for a couple of years, this can lead to disastrous consequences for the US economy. Again, it will be objected that this is not a problem, the US will simply print money. Yes, it is possible, but the problem is that the Fed prints money, it also receives bonds in exchange for money, but the Fed is not printing money now and is not going to do this for at least another six months.

Then who in their right mind would buy bonds with a 4% yield at 10% inflation? No, of course there will be those who wish to do so, and if not, then they can be asked to buy US bonds, for example, by raising the bank reserve requirements. Ultimately, the problem can be solved by restarting the printing press, and this is where the most important thing begins - the impact of this process on the dollar.

It is clear that key central banks are in direct contact with the Fed. It is also clear that the growth of the dollar and interest on loans leads to a series of defaults in developing countries. It is clear that the euro and dollar rates are manipulated and coordinated. One thing is not clear - is the ruin of the eurozone a priority for the American establishment and does it correspond to its interests? I think not.

In this regard, it can be assumed that if the Fed manages to cool inflation in the next few months, then we will soon hear assurances of the end of the policy of tightening rates, while the European Central Bank began its policy of raising rates quite recently. In this regard, I have an assumption, which is nothing more than my imagination, and it consists in the fact that the dollar and the euro are close to the end of their trend. The dollar is close to the end of growth, and the euro is close to the end of the decline.

Fig. 2: Foreign exchange market, EURUSD rate

At this point, I would like to emphasize in particular that the EURUSD has not yet formed a reversal. Moreover, I think it can go even lower. However, I assume that the movement has entered the last phase of its decline. This scenario may be prevented by the collapse of the US stock market, which, due to increased demand for the dollar, will lead to a further collapse of the euro and other currencies. Therefore, we need to keep an eye on the S&P 500 3600 level. Overcoming this level will open a new page, and then the scenario can develop rapidly. A sharp rise in the dollar, a collapse in the euro, a reduction in Fed rates, a collapse in the dollar and a rapid rise in the euro.

However, God forbid you now stand up against the dollar and buy any currencies. The market may turn around, but without your deposit. In this context, one must hope for the best and prepare for the worst. Even if Powell's statements lead to the fact that the US stock market rises, this will not lead to a reversal of the euro here and now. Moreover, this may become a prologue to an even greater increase in rates by the Fed at the next meeting.

What about oil, inflation and commodity prices, you ask? But no way, these markets have recently been living in their own reality, and we can see double-digit inflation and the dollar at all-time highs against all currencies, but that will be a completely different story. Be careful and cautious, follow the rules of money management.